Barnard Discusses...

Proposed $100 Million New Middle/High School Building

Since you're short on time, let's get to the main points. The school board is proposing a $100 million new middle/high school building (the bond amount would actually be $99 million). You as a property tax payer will pay for the vast majority of the cost. If the proposal is accepted by the voters of the school district on Tuesday, March 5th; your taxes will go up beginning with your tax payment in August of 2027.

The school district finance director provided to the public an Excel spreadsheet so you can estimate your tax increase. You can download it here. To make it easier if you don't have Microsoft Excel on your computer; you can get an estimate right on this website - click here.

The proposed school building was presented to the residents of Barnard on Feb 15th. A video recording (click here) was made of the presentation as well as a lot of questions from the public; both in-person and online. To save you some time, there is a list (right below the video) of questions or comments from the public. Click on one of the questions and you'll jump to the part of the video where that is discussed.

Remember to VOTE on Tuesday, March 5th; "Your Vote is Your Voice".

Learn Before You Vote

There was a gathering of people from Barnard on February 15th to hear from 2 school board members and 2 school district administrators about a proposed new middle/high school. The building is intended to replace the existing middle/high school building.

The meeting was well attended both in-person and online. The format of the presentation allowed for questions and comments throughout. The attendees took full advantage to voice their thoughts about the proposed $100 million building project (the bond amount would actually be for $99 million).

Quite naturally, many of the questions touched on: (a) justification of the need for a new building; (b) the size and configuration of the proposed building, and; (c) the cost and cost reductions.

A vote will happen on town meeting day, Tuesday, March 5th in all towns that make up the Mountain Views Supervisory Union (formerly, Windsor Central Supervisory Union; WCSU).

There has been a lot of talk in the media and the public in recent weeks about property taxes and the potential tax surge. The vote on this project is not directly related to the possible tax increase that you'll see in your mailbox this summer.

If this project is approved, you would see the tax increase in 2027. The school district's finance director provided an Excel spreadsheet that you can download (here) and estimate the tax impact of the project on you. If you are not able to run that spreadsheet, a simplified tax estimator is included on this website (here); the answers it provides are based on results from the school finance director's spreadsheet.

You can watch the presentation and hear the questions from Barnard residents on the video below.

See the LIST of QUESTIONS below the video.

CLICK on a QUESTION and JUMP directly to that part of the video.

Find Out Your Estimated Tax

to Pay for the Proposed $100 million Middle/High School

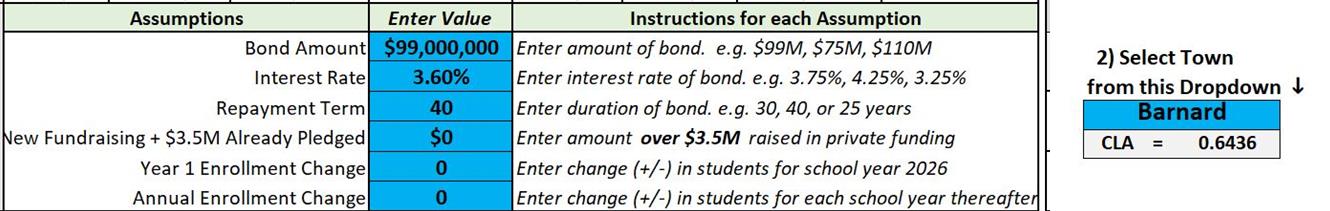

The finance director of the school district provided to the public a spreadsheet to estimate the tax impact of the proposed new school building. The spreadsheet can be downloaded from the school district site, here. The spreadsheet in its calculations uses a bond amount of $99 million. To use the spreadsheet, here's what you should know.

Your computer needs to have Microsoft Excel installed on it. You also need to know the basics of running Excel. If that's a bit too much for you to deal with, this website has taken the results of the finance director's spreadsheet and made it more convenient for you to get your tax estimate (for NON-income-sensitized homeowners).

NOTE: Income-sensitized homeowners will have an estimated tax that is LESS than shown in the Tax Estimator. To get the income-sensitized tax estimate, download the Excel spreadsheet from the finance director, here.

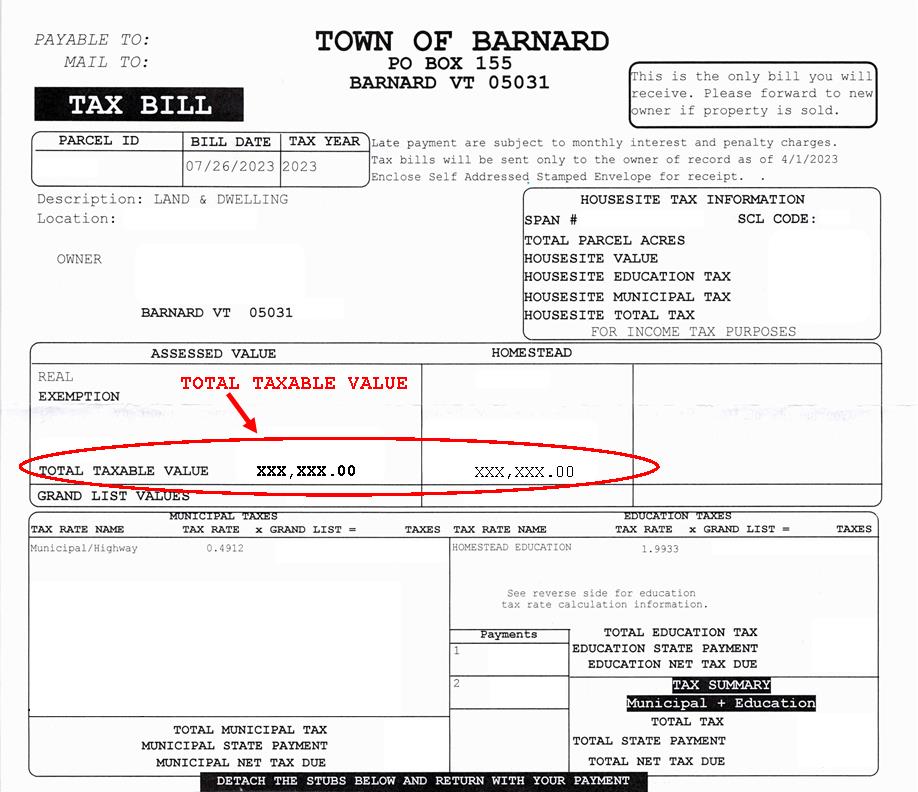

One thing you'll need is your recent property tax bill. You only need 1 number from it, the TOTAL TAXABLE VALUE. Look at the sample tax bill below and you'll easily see where that figure is located.

The estimated tax values (for NON-income-sensitized homeowners) are based on the results obtained from the spreadsheet provided by the district finance director. The spreadsheet shows some assumptions that are subject to change. Those assumptions are shown in the image below.

NOTE: Income-sensitized homeowners will have an estimated tax that is LESS than shown in the Tax Estimator. To get the income-sensitized tax estimate, download the Excel spreadsheet from the finance director, here.

How to Use

the Simplified Tax Estimator

- Write down the TOTAL TAXABLE VALUE from your recent property bill.

- If your TOTAL TAXABLE VALUE is between $200 thousand and $1 million, use TAX ESTIMATOR A.

- If your TOTAL TAXABLE VALUE is between $1.1 million and $3.0 million, use TAX ESTIMATOR B.

- Click the appropriate Tax Estimator button below and follow the simple instructions. You'll be done in less than 30 seconds.